1.5 - Mastering (RSI) Divergence as a leading Indicator

RSI

RSI is a price momentum indicator with reading of overbought and oversold

- Areas below 30 suggest oversold and areas above 70 suggest overbought

- The RSI is considered "reset" when it goes from one extreme to the other (70 to 30)

Divergence

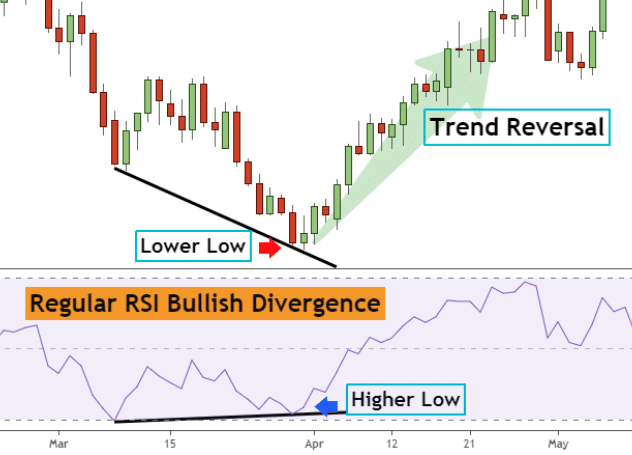

- Divergence is when the price and indicator show different structures.

- Bullish divergence increases the probability that a reversal will happen with more force and shouldn't just go sideways

- When looking for divergence, you can only count it after a "reset"

- Divergence isn't confirmed until a pivot is in, until then it's just potential divergence

| Bullish divergence | Bearish divergence |