Skip to main content

1.1 - Pivot points, market structure & the three phases of major trends

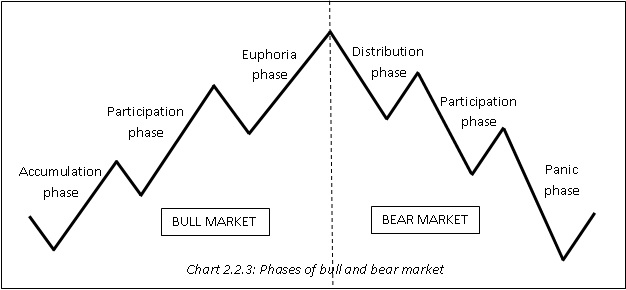

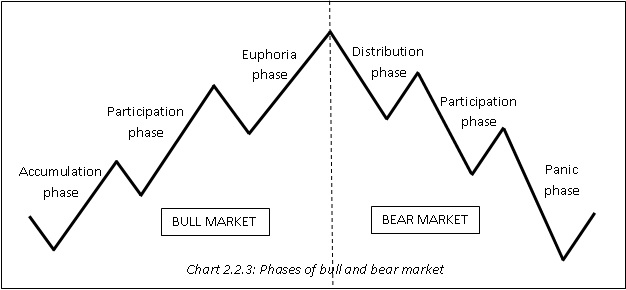

The three phases of a trend

- Accumulation

- Public participation

- Excess

Accumulation

- Occurs after a prolonged decline or bear market

- Smart money starts buying UNDERVALUED assets (just because something is down bad, doesn't mean it can't go down more)

- Sentiment is usually pessimistic

- Low trading volumes

Public participation

- Momentum builds as more investors recognise the trend

- Media and public interest increases

- Prices rise significantly due to higher demand

- Positive sentiment

Excess

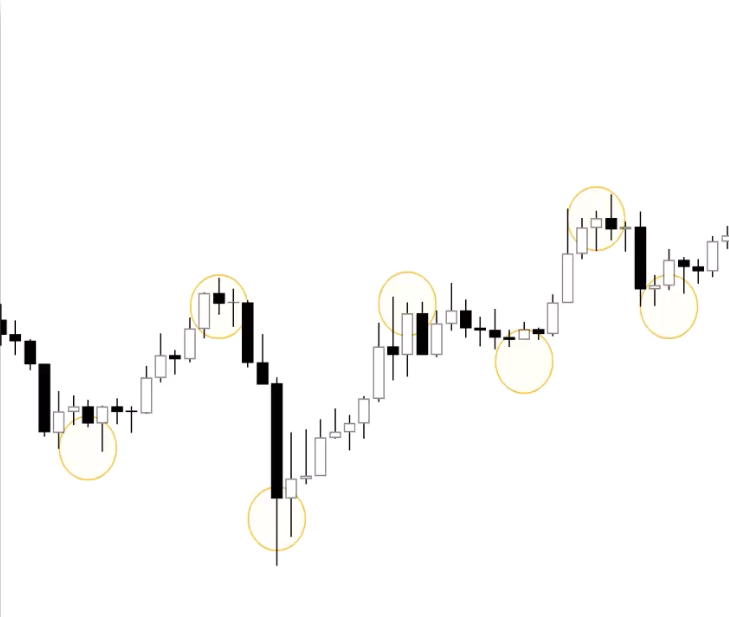

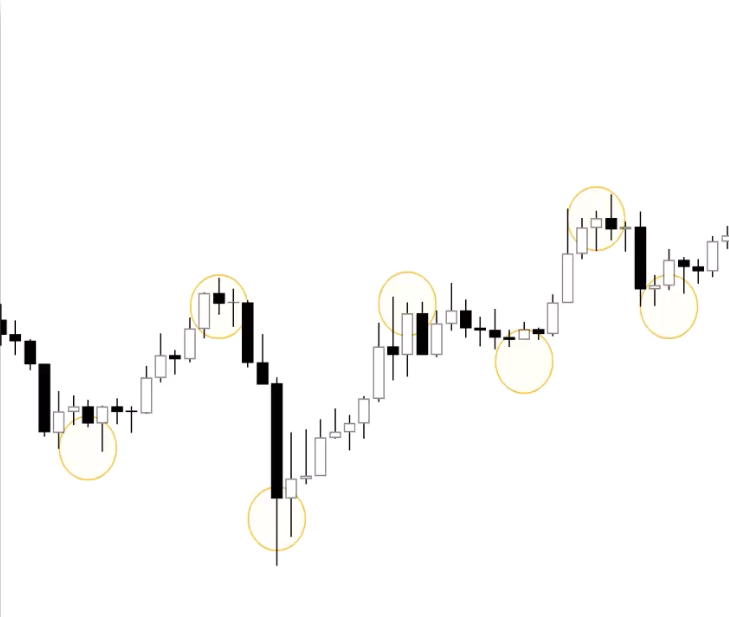

Pivot points

- Identified by

- 3 candles going in the opposite direction

- "V" or "U" shaped pivot reversal

The 3 Types Of Market structure

Bullish (HH / HL)

- The market is going up

- Marked by consistent higher highs and higher lows

- Pivot peaks are higher then the previous highs

- Signals increased demand and optimism

- Pivot lows are higher then previous low

- Signals resiliance as traders prevent the price from dropping significantly

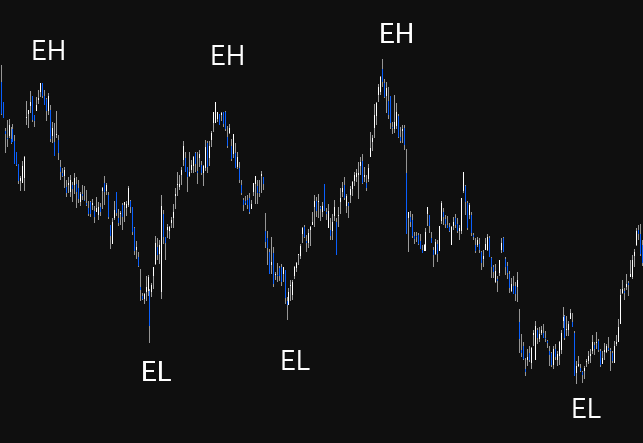

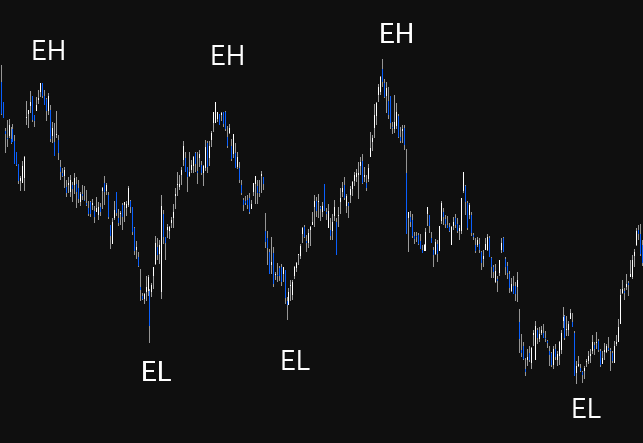

Consolodation (EH / EL)

- Market moving sideways

- No clear trend

Bearish (HH / HL)

- Market is down down down

- Can be good for shorting