2.4 - Pattern recognition for confluency

Ascending triangle

Bullish reversal & continuation pattern

- Higher lows each move

- Look for hidden bullish divergence on the higher lows until the RSI comes back into convergence & look for a COMS on the RSI

- Check if the OBV is supporting of leading the move for a vote of confidence

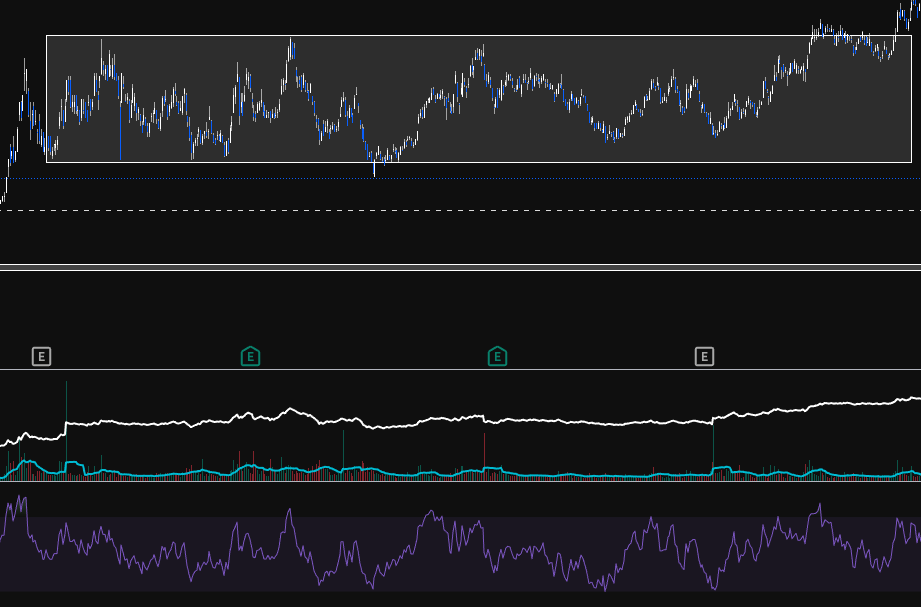

Darvas Box

A neutral formation that can be bullish or bearish

- Look for a COMS before the breakout somewhere in the box

- RSI can show hidden bullish at the start / pre box as extra confirmation

- Look for OBV to support a breakout

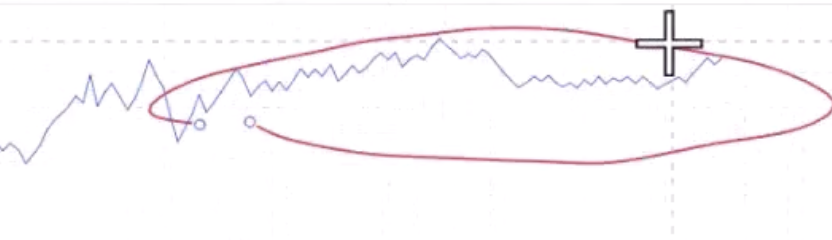

Bull flag

- Strong impulsive move should form the pole, then a form of consolodation, usually in the form of a channel.

- Measure fibs from first down COMS (reversal) to top COMS (revsal) (An impulse move (zig) is from the end of the last zag to the next zag)

- Check if volume did NOT support the move down and DID support the move up

- Compare larger pivot points for hidden bullish divergence

- When you find a COMS at the end of the bull flag, look for:

- A break through a decline

- Low down volume

- RSI continuation

- Bounce off 0.382 area

Head & Shoulders

This is a bearish reversal pattern (failure swing)

- The left shoulder is formed on increase positive volume

- Divergence is found from the top of the left shoulder to the top of the head

- The head will form on lowing / flat OBV, signalling weakness in the trend.

- The right shoulder will be formed on even lower OBV, showing weakness in the dip buyers

- When the neck line is broken, the pattern is confirmed and there should be increasing down volume on the sell off (even lower OBV)

- The measured move is from the neckline to the top of the head.

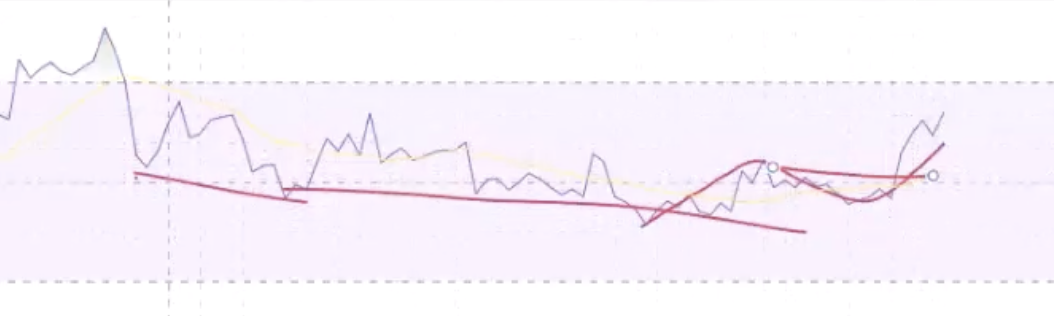

Falling Wedge

- If a wedge starts forming into a zag zone, that should be the end of the ABC

- OBV should not support the move down and should support the move up

- Bullish divergence off the bottom of the wedge adds a point of confluence

- Hidden bullish divergence off the low if running into a zag zone

- Hidden bearish could be found at the top of the wedge if not at a bottom