1.4 - Volume analysis, Wyckoff techniques & On-balance Volume

Volume

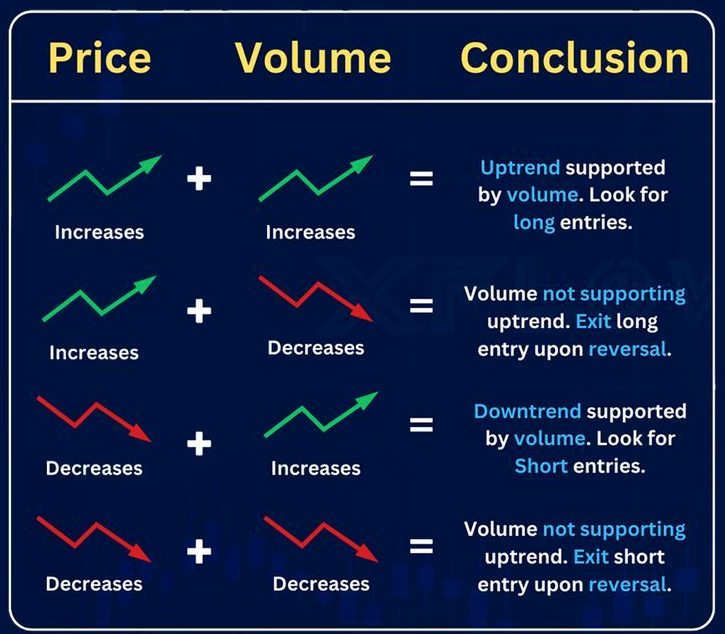

Dow theory stastes volume must confirm the price

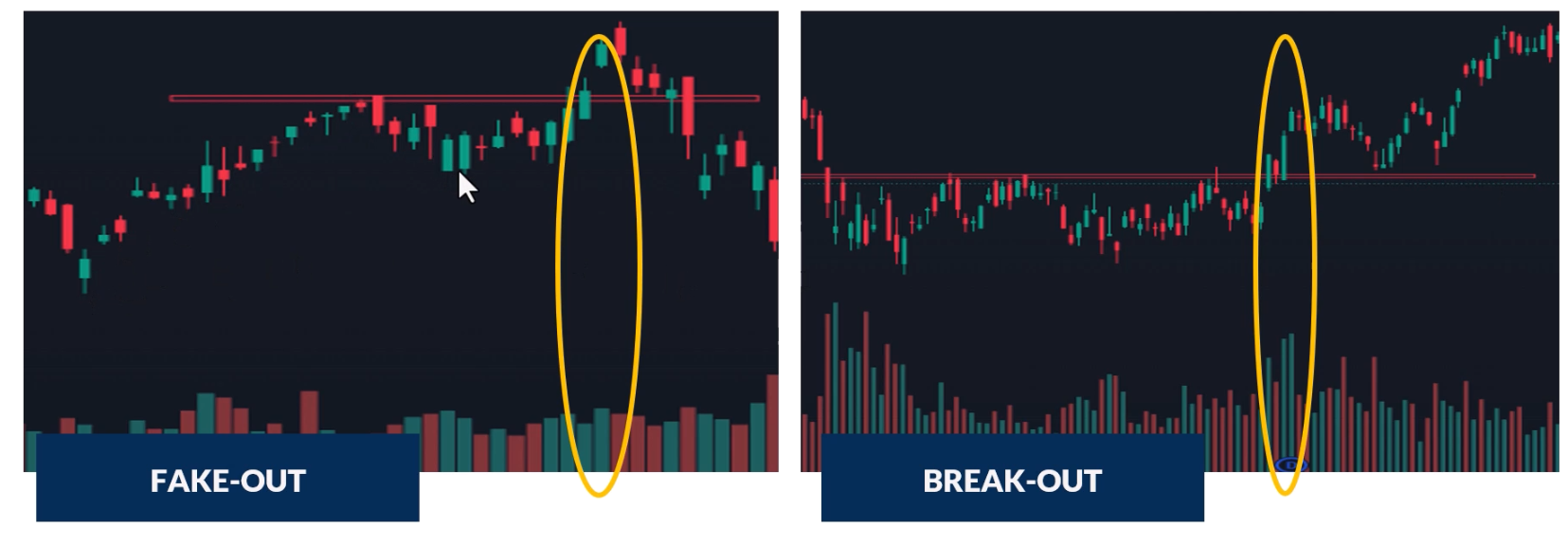

- The theory states that if volume is increasing along with the price trend, it suggests the trend is valid, if volume doesn't confirm the move it may suggest the move is a fakeout

- If there is high volume at support and resistance levels, it means the level will be quite strong

Wyckoff theory suggests suggests a big move should converge with big volume (effort = result)

Volume convergence (big effort turned into big result)

|

Fake out (big effort but no result)

|

OBV

Just like all indicators, price is primary, OBV is secondary (price action is king)

- On Balance Volume (OBV) is a leading indicator and changes direction before price, it can help traders predict where price action may head.

- OBV reveals the intentions of traders and shows the interactions between retail and the big boys.

How to interepret the OBV

- If OBV is rising, it means the volume on up days is bigger then the volume on down days.

- If OBV is falling, it means the volume on the down days is higher then up days.

- OBV is a great indicator for assessing the liklihood of successful breakouts or breakdowns by detecting convergence or divergence

- You can also do TA on the OBV and use it as a sell indicator

In short: the idea behind OBV is that price should follow volume.

If price keeps making higher highs but OBV hovers at or below a previous resistance level you have bearish divergence!