1.3 - Reversal patterns, trend lines & channels

The trend is your friend

- A trend will persist until its reversal is indicated

- Understanding the trend helps traders avoid unnecessary speculation and align their trades with the dominant market direction

- A trend stays in motion until external factors cause a shift, such as news, economic data, or exhaustion in buying or selling pressure

The three reversal patterns

Failure swing |

Double top/bottom |

Non-Failure swing |

|

|

|

A breach of the prior support signals a potential change of the trend & represents a technical sell signal

Trend lines

Dow theory states that the only valid trend line is horizontal as angled trend lines are subjective

- Trend lines can help identify when a trend may be about to change

- Trend lines should be drawn to connect as many points as possible

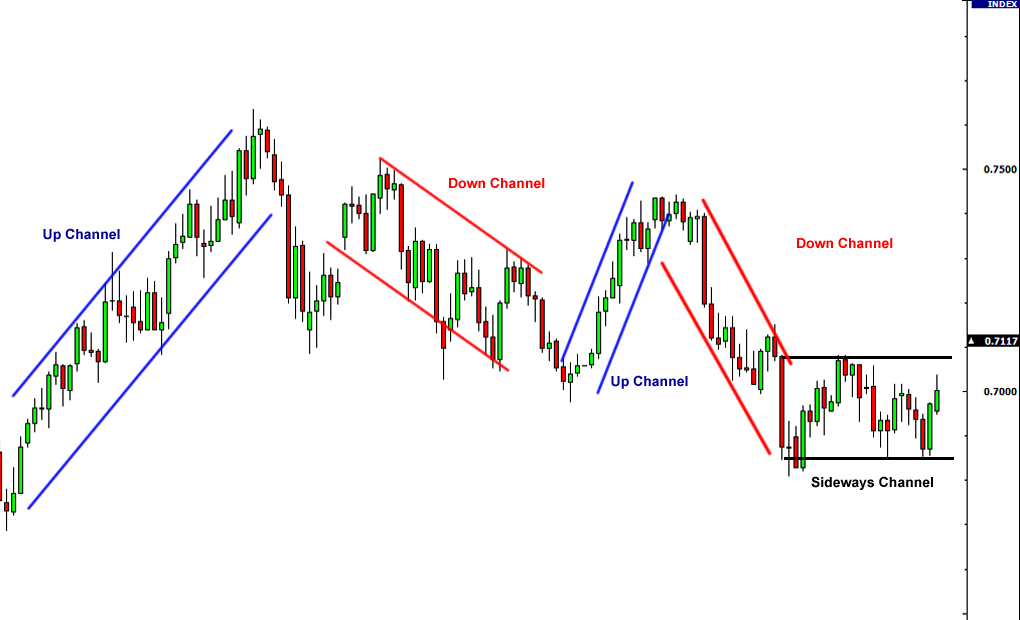

Channels

- A channel is a continuation pattern where price moves between parallel trendlines

- Channels can be upward, sideways or down